How Do I Know Which 1099 Form to Use

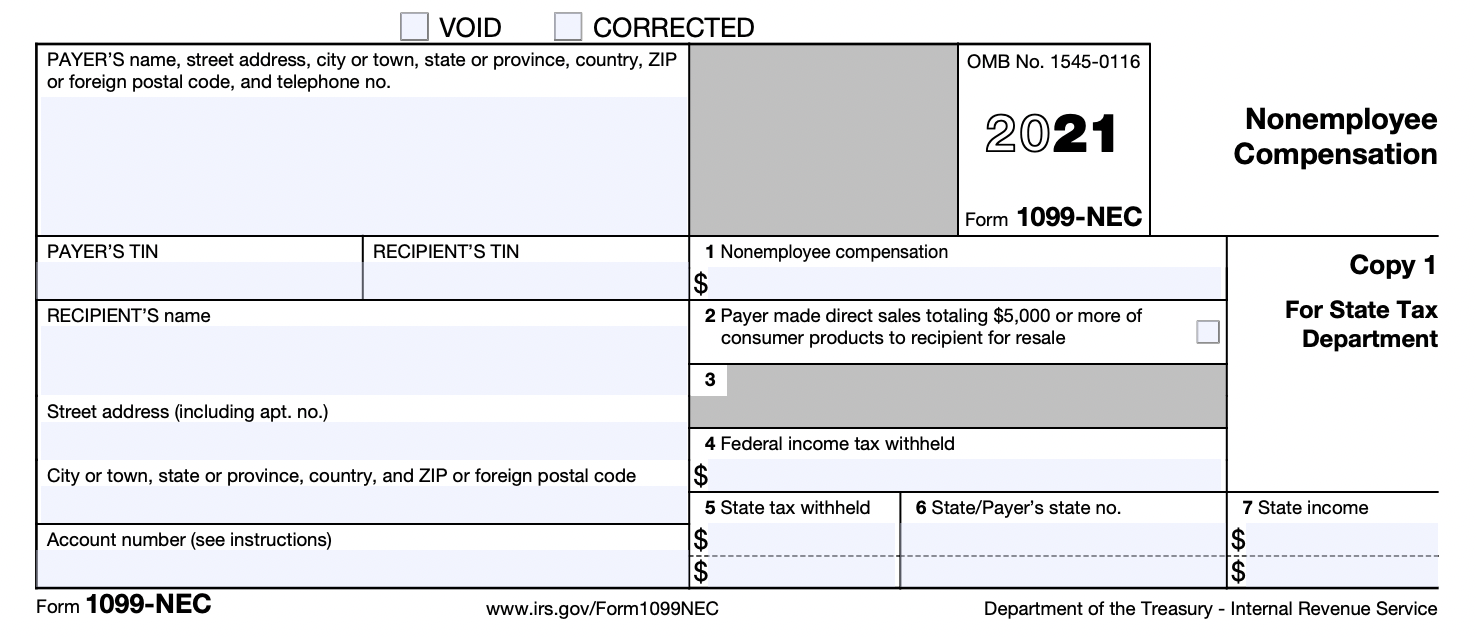

The 1099-NEC didnt exist before 2020. The 1099-R form is an informational return which means youll use it to report income on your federal tax return.

1098 Vs 1099 Tax Forms Fundsnet

However if you traded stocksoptions of different securities via your brokerage and those are not your company stocks then you will mark that question as a NO since its not related to your company.

. If you earned more than 10 in interest from a bank brokerage or other financial institution you. Provided you only use the funds to pay qualified medical expenses box 3 should show the distribution code No. Complete the W-9 form for each.

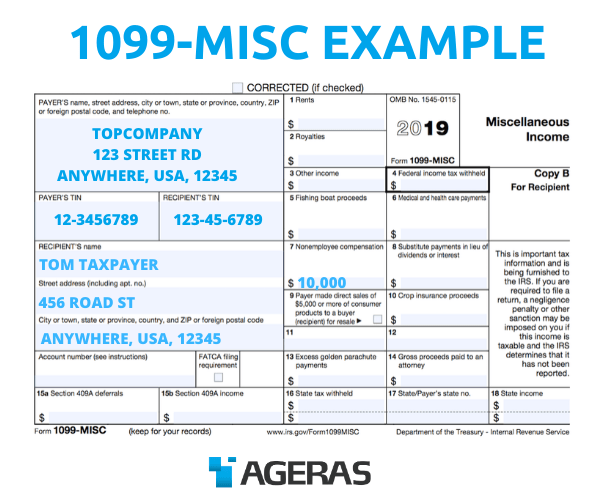

Wages paid to regular employees are already covered by W-2 forms. Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of. To correctly prepare your Form 1099s based on IRS rules use these seven easy steps.

A 1099 form is a record of income. OR by clicking on the Taxes menu option on the web. So if you did that you would know that the 1099-B which you received is related to ESPP.

Use Step-By-Step Guide To Fill Out 1099-MISC. So How Do I Prepare the 1099 Forms. 1 which indicates normal tax-free distributions.

Highlight the recipient to add the form to. Cash App and Form 1099-K FAQs. You will receive a Form 1099-SA that shows the total amount of your annual distributions ie.

Form 1099-K is used to report transactions for the sale of goods andor services through peer-to-peer P2P payment services like Cash App. You can order paper 1099 forms from the IRS by calling 800-TAX-FORM 800-282-3676. 1099 refers to the IRS Form 1099.

When filling out the paper form make sure you get Form 1096 alongside your 1099 form fill them out and mail them together. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. A 1099-INT tax form is a record that someone a bank or other entity paid you interest.

This form should be used when i you pay compensation of at least 600 in a fiscal year ii to a person who is not employed iii for the services provided by a person iv during their cause of your business or trade. For a business there are some exceptions to the 600 rule. Consider talking to each contractor to ensure no information has changed since they filled out the W-9.

Double click on the payer name. 1099-Ks on the other hand are issued by the credit card company or payment app used to pay you. Money you used reported in box 1.

Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC. They include payments to corporations except under very specific conditions. 1099-MISC 1099-NECs are sent directly by the client or platform you worked for.

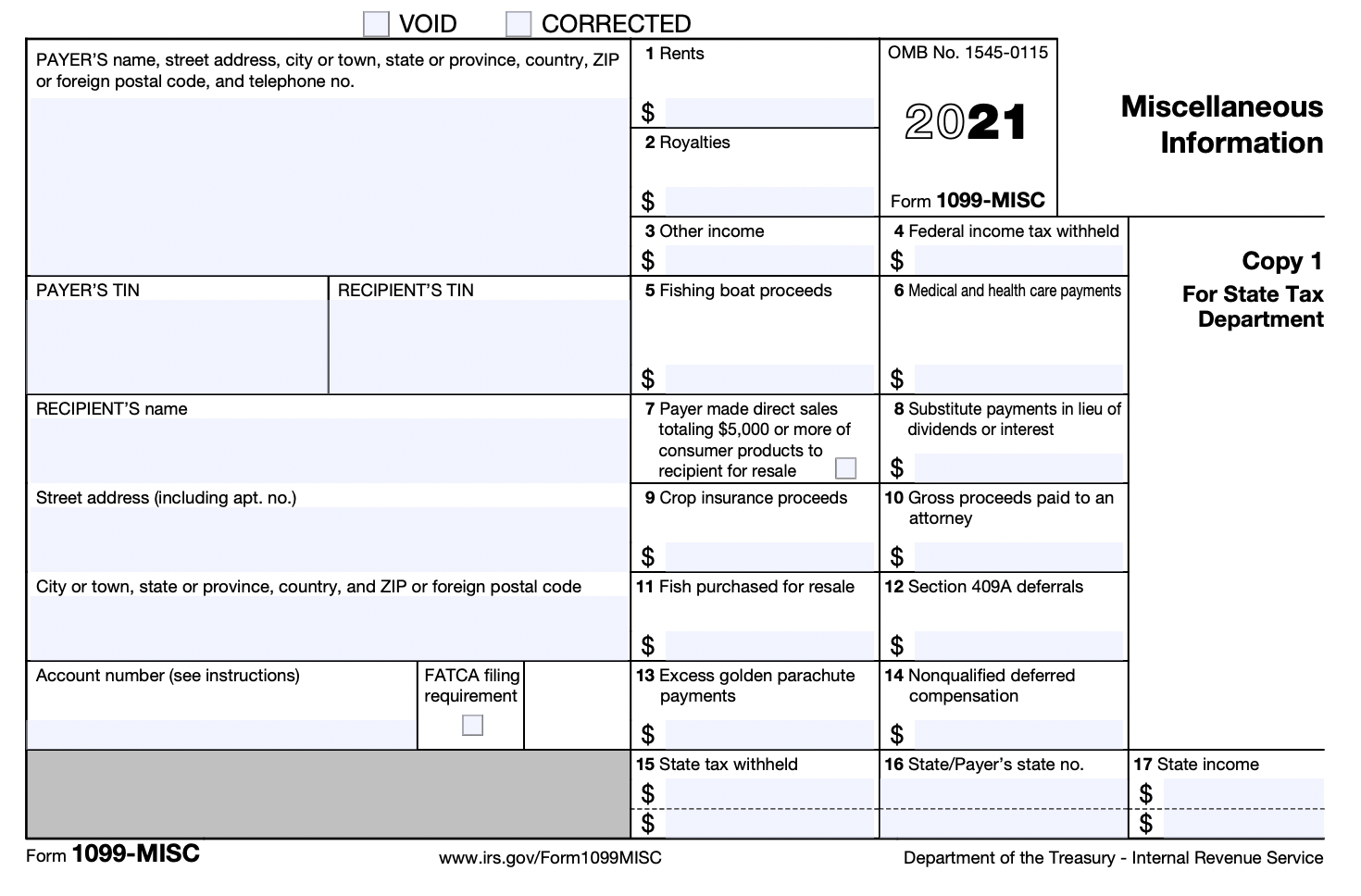

Enter the closing date. And do not use Form 1099-MISC for W-2 employees. Click to see full answer.

Print File Instantly- 100 Free. When you file a physical Form 1099-NEC you cannot download and submit a printed version of Copy A from the IRS website. Tax Forms Made Simple - Save Time File Instantly With The IRS - Export To PDF Word.

You have the option to summarize by Sales Category. If any of these four items do not apply to a situation you do not need to file 1099. For example freelancers and independent contractors often get a 1099-MISC or 1099-NEC from their.

Where Can I Find My 1099 Form. 1099-B Adjustment codes - How to know what to use. Click on the Tax Form and in the expanded view locate the Download Print Form option near the bottom.

Click on the Add Form button. Get every dollar you deserve with unlimited tax advice from experts who know self. In 2022 the Internal Revenue Service IRS made changes to reporting requirements for Form 1099-K.

From there click on the Tax Year at the top and select the appropriate year. Do I need to worry about Form 1099-K. Once you have all of the required information use it to fill out Form 1099-NEC.

Choose 1099-S from the Form Type drop down menu. Form 1096 is a summary form of all the Forms 1099 you file. Form 1096 summarizes the 1099 forms you plan to issue and should be sent with copies of 1099.

This will start a download of your 1099 form. How do I know to use the 1099. If you are an independent contractor it is not your job to fill out a 1099.

Ad Get A Fillable 1099 Created By Our Tax Experts. Print File Instantly- 100 Free. Paper 1099 forms.

If your business hired the contractor and paid them more than 600 in a year you are responsible for issuing the independent contractor a 1099-MISC form. Copy A of Form 1099-NEC must be submitted to the IRS by January 31 regardless of whether you file electronically or by mail. Youll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040.

Tax Forms Made Simple - Save Time File Instantly With The IRS - Export To PDF Word. You have questions we have answers. Check if this box applies.

If the form shows federal income tax withheld in Box 4 attach a copy Copy Bto your tax return. Comment on Tax Forms and Publications. However you can still use Form 1099-MISC for reporting nonemployee compensation for tax years prior to 2020.

File Form 1099-MISC for each person to whom you have paid during the year. The code is shown on your 1099-B. The 1099-MIC is the most used form and as a business or an individual that is most likely the one you will see.

Fill in the necessary fields on the form. As of 2020 do not use Form 1099-MISC to report nonemployee compensation. Confirm that you have the correct information for each contractor or vendor.

Click on the Payer List button. Help with Forms and Instructions. If you are going to try to aggregate certain transactions using the summarize option you will need to aggregate transactions with the same adjustment code.

Learn more about the differences between these forms in our guide to 1099-NEC vs. Ad Create Edit and Export Your 1099 Misc. E-File With The IRS - Free.

Payers use Form 1099-MISC Miscellaneous Information or Form 1099-NEC Nonemployee Compensation to. Submit Copy A to the IRS. Ad Get A Fillable 1099 MISC Tailored To Your Needs.

All kinds of people can get a 1099 form for different reasons. Date of closing. Form 1099-MISC which you might also have heard of isnt used for freelance income anymore.

The best way to determine if you need to issue the 1099 is using a W-9 Form. When you file a 1099 form you also need to complete and file Form 1096 Annual Summary and Transmittal of US. Form Quickly and Easily.

If you are the sole proprietor of your own business or if youre an LLC and you do work for clients youll receive a Form 1099-NEC.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

All You Need To Know About The 1099 Form 2021 2022

Form 1099 Nec How To File The Forms Square

Tax Print Forms For 1099 Nec And 1099 Misc Withholding Tax Return In Sap Business Bydesign Sap Blogs

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Tax Print Forms For 1099 Nec And 1099 Misc Withholding Tax Return In Sap Business Bydesign Sap Blogs

Do Llcs Get 1099 S During Tax Time Fundsnet

Printable Form 1099 Misc 2021 Insctuctions What Is 1099 Misc Tax Form

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Understanding 1099 Form Samples

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

What Is The Difference Between A W 2 And 1099 Aps Payroll

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Read Your 1099 Justworks Help Center

Irs Tax Form 1099 How It Works And Who Gets One Ageras

/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Very Useful post. Get services of 1099-nec-form

ReplyDelete